Turnkey liability management

Unitholder register, order centralisation, NAV validation, capital calls and distributions. Outsource your middle-office.

What we handle

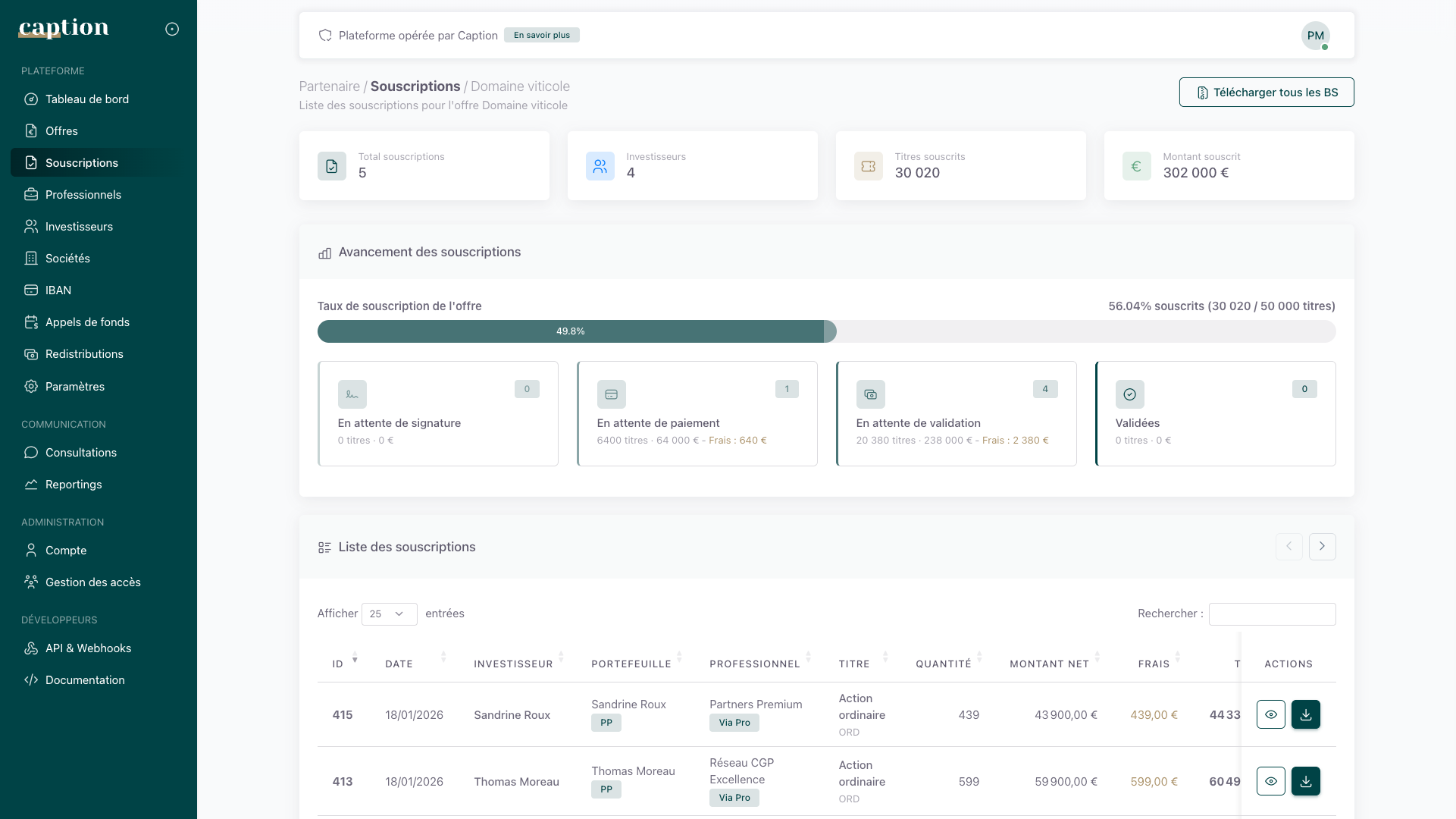

Unitholder register

Continuous maintenance and updating of the nominative register of unit or share holders. Every movement — subscription, transfer, assignment — is traced and historised to guarantee an impeccable audit trail.

Order centralisation

We receive, validate and centralise subscription and redemption orders as ISP. Threshold controls, automatic entry/exit fee calculation and immediate confirmation to subscribers.

NAV & reporting

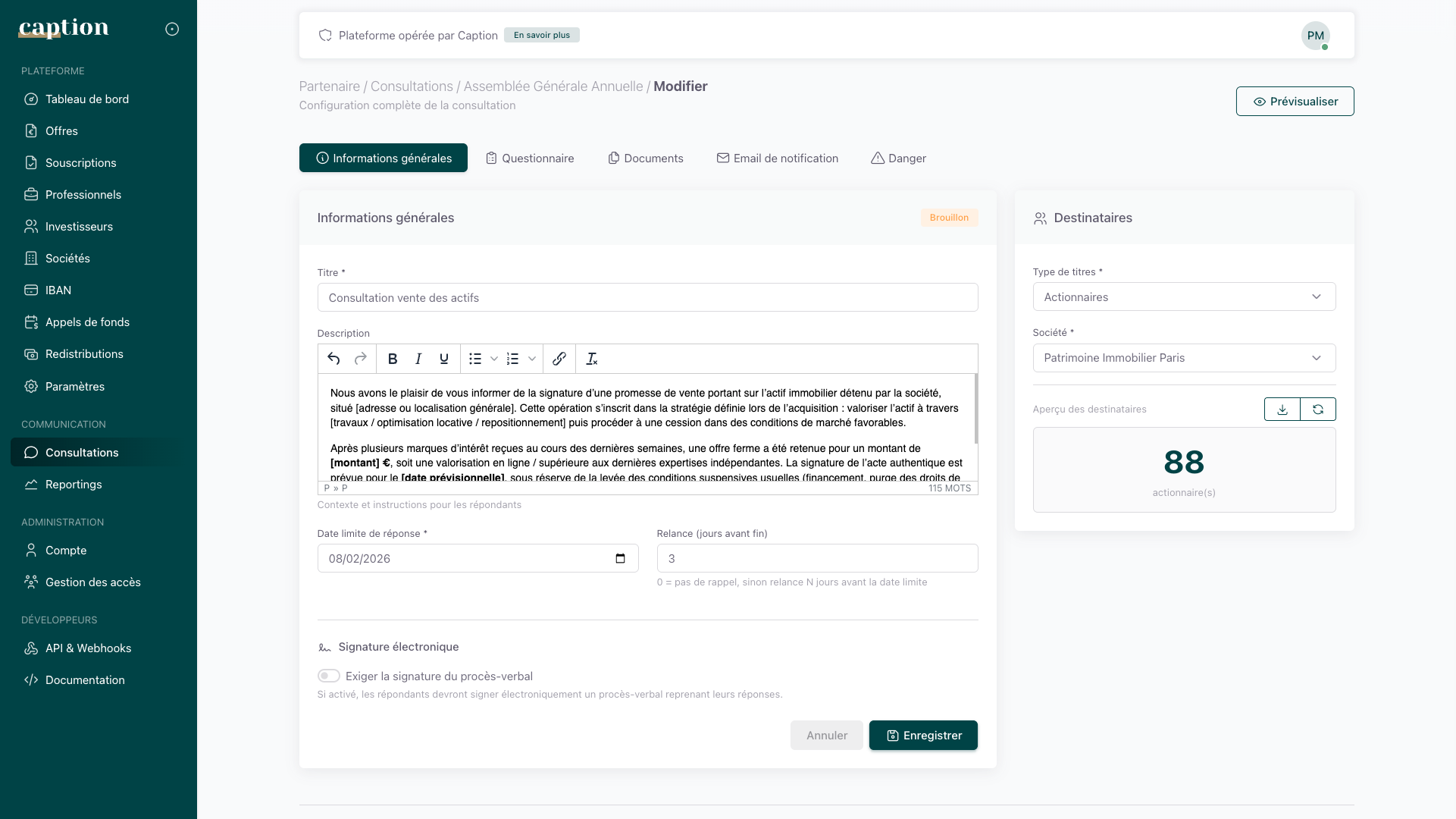

Periodic validation of the Net Asset Value according to the methodology defined in your fund documentation. Automated production of regulatory reports and position statements for your holders and distributors.

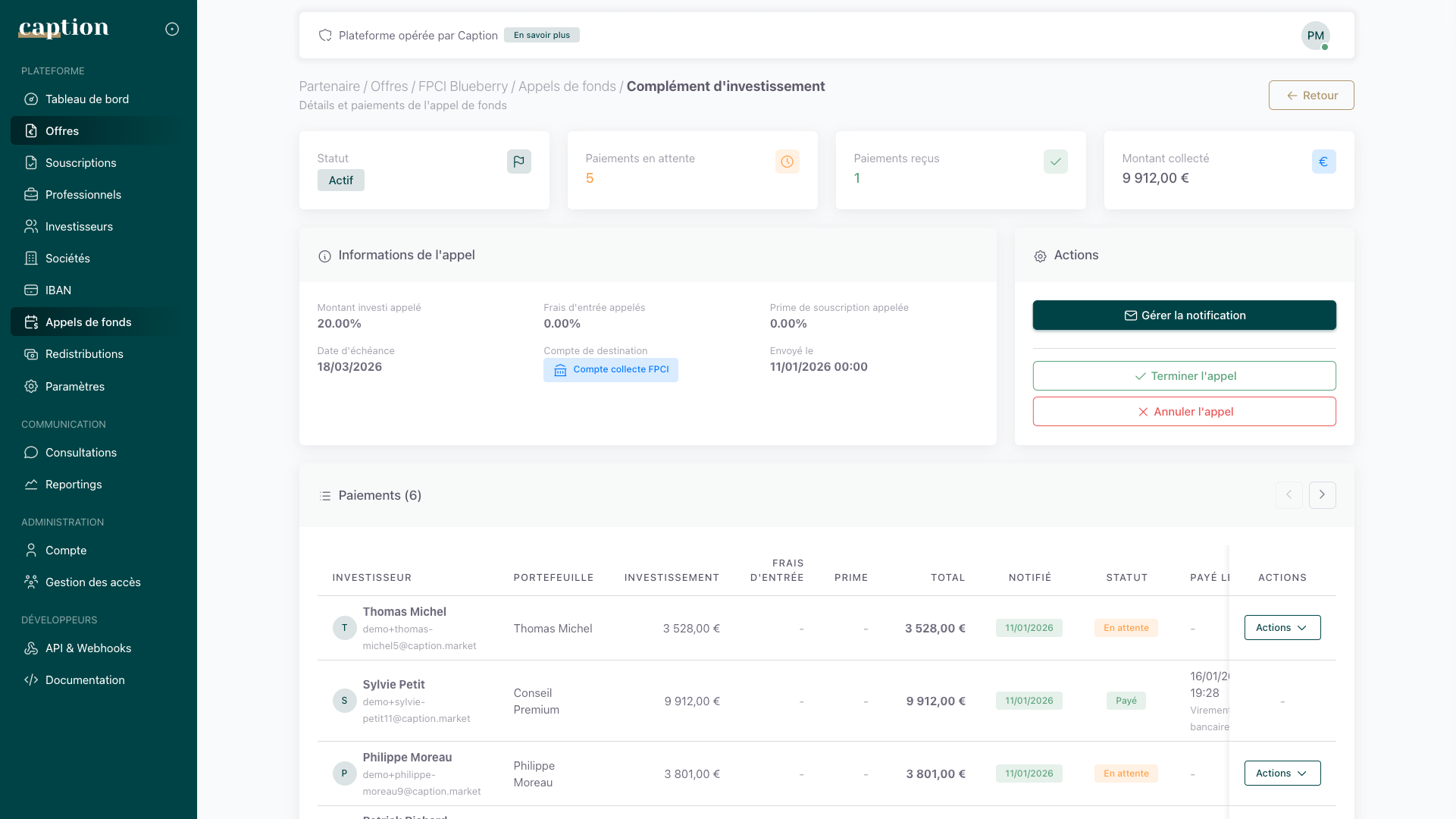

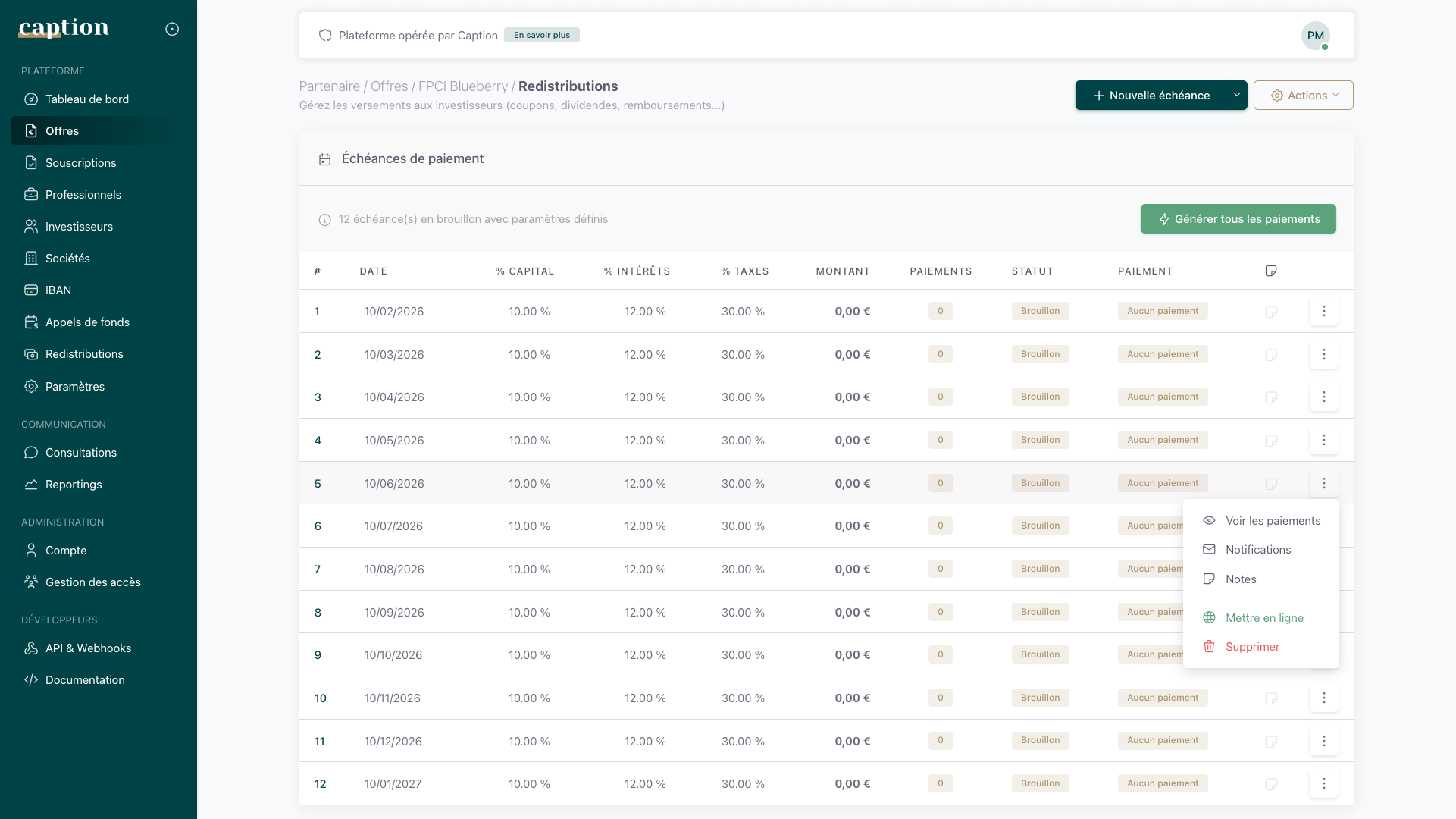

Capital calls & distributions

Planning and execution of capital calls, real-time collection tracking, then calculation and payment of distributions to holders. All managed from your dashboard, in accordance with the fund documentation.

Liability management tools

Why outsource to Caption

Dual ISP + AMC licence

Our dual licence (ACPR + AMF via Clint Capital) gives us a complete view of liability management challenges, from both the AMC and distributor sides. A single point of contact who understands both sides of the equation.

Integrated platform

Liability management is directly connected to our subscription, compliance and reporting platform. Zero double entry, zero manual reconciliation: data flows end-to-end.

Scalable

Our infrastructure currently manages thousands of holders and dozens of vehicles simultaneously. It adapts to your assets under management: whether launching your first fund or industrialising your range.

Frequently asked questions

Liability management consists of administering relationships with a fund's subscribers: register keeping, order centralisation (RTO), capital calls, distributions, investor reporting and unit transfer management.

Caption acts as an ACPR-licensed ISP to centralise subscription and redemption orders (RTO), manage capital calls, administer distributions and provide investor reporting through our digital platform.

All collective investment vehicles: FPCI, FCPR, SLP, ELTIF 2.0, AIF, SCI and club deals. Our platform adapts to the specificities of each vehicle and its legal documentation.

Reception-Transmission of Orders (RTO) is handled by Caption as ISP. We centralise subscription forms, verify KYC compliance, collect funds and transmit orders to the register keeper.

Yes. Our platform automatically generates periodic reports: unit valuation, performance, capital calls and distributions. Each investor accesses their personal space with the complete history of their operations.

Yes. Caption interfaces with existing depositaries. Our role is complementary: we manage the investor relationship, digital subscription and reporting, while your depositary retains its custody and control role.

We offer several service tiers adapted to your situation: an offering for first vehicles covering the register and order centralisation, an offering for growing AMCs with NAV validation, capital calls and personalised reporting, and a bespoke offering for institutional players with dedicated API and depositary integration. Contact us for a proposal tailored to your assets under management and vehicles.

Message sent

We have received your message and will get back to you shortly.

Let's discuss your liability management

Let's discuss your needs. Our team will advise you on the appropriate level of outsourcing for your structure.